Every business reaches a moment when it needs to answer a deceptively simple question: Who are we, and where are we going?

That’s the essence of brand positioning. And while the word gets tossed around in marketing meetings and boardrooms alike, its definition varies wildly depending on the lens you’re using — customer-centric, marketing-driven, internally focused or business-led. For executives making critical decisions about growth, market fit and differentiation, it’s essential to get on the same page about what positioning really means and how to make the right choice for your organization.

Defining positioning through a strategic lens.

At Ervin & Smith, we favor the definition that connects positioning directly to business strategy:

Brand positioning is the strategic choice of where your brand will compete and how it will win — based on customer needs, competitive dynamics and your organization’s unique strengths.

Said another way: What do you do, who do you do it for and why should anyone care?

Done right, positioning becomes more than a marketing exercise. It becomes a lever for business growth — shaping how customers see you, what market space you occupy and what makes your offering distinct and valuable.

Where to begin: Two strategic frameworks that are worth your time.

For executive teams reevaluating their market position — or just looking to sharpen it — there are two models worth considering: the Ansoff Matrix and the Centrality-Distinctiveness (C-D) Map. Each offers a practical, strategic lens to help guide decision-making and alignment.

Framework 1: Choosing your growth strategy with the Ansoff Matrix.

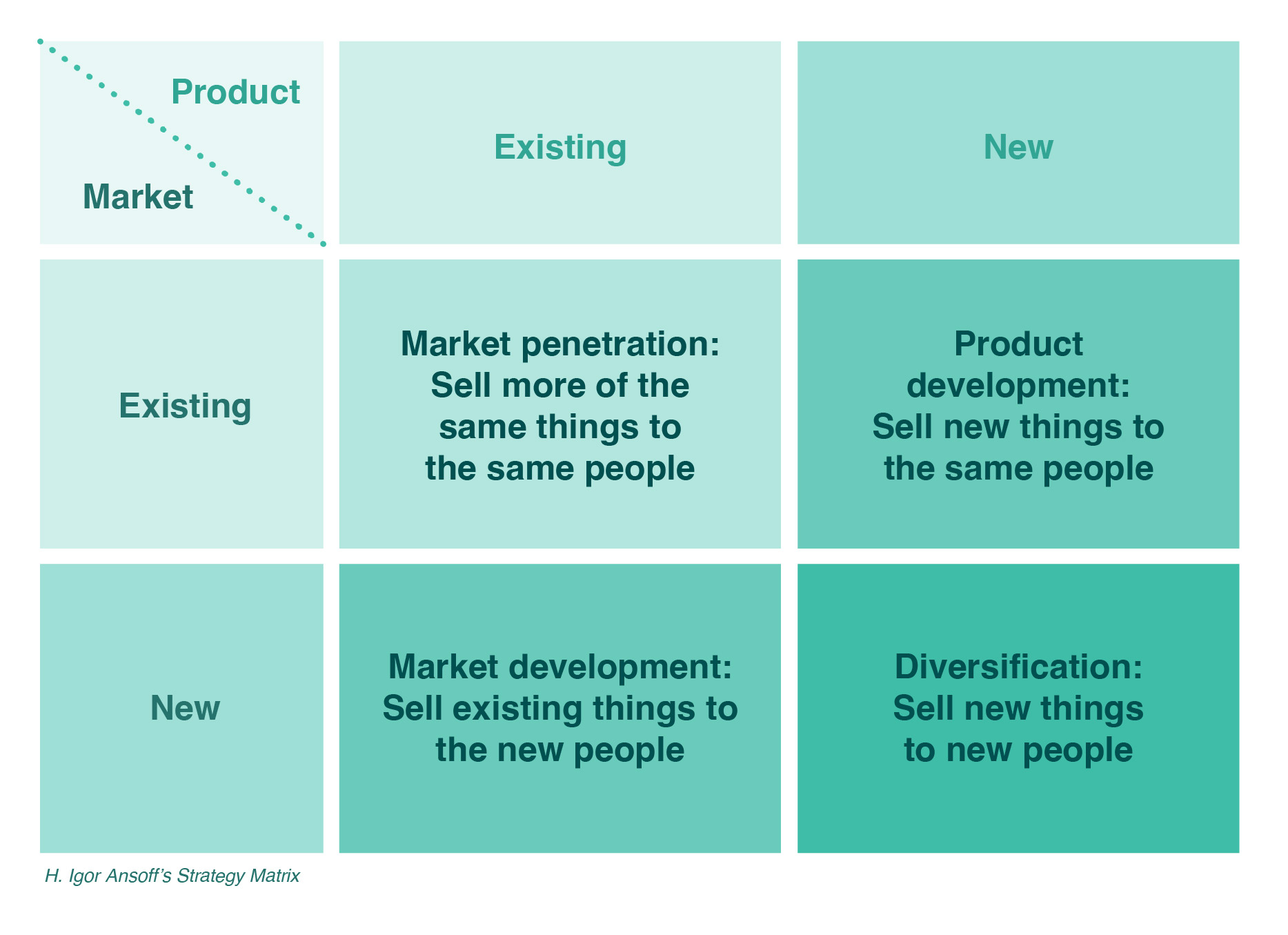

While originally developed in 1954, the Ansoff Matrix remains a powerful way to frame growth decisions. It breaks business strategy into four categories based on your products and markets:

- Market Penetration: Sell more of what you already offer to the market you already serve

- Market Development: Find new markets for your existing offerings

- Product Development: Create new offerings for your existing customers

- Diversification: Launch new offerings for new markets

Each path implies a very different positioning strategy. Let’s say you’re a specialty coffee chain. If you focus on market penetration, your brand might position around loyalty and convenience — subscriptions, rewards and habit-building touch points. If you’re leaning into product development, your positioning shifts toward innovation and taste leadership — limited-time blends, curated experiences and seasonal moments that keep loyal customers excited.

Now imagine a B2B financial consultancy. A market development strategy might mean moving from mid-market clients to enterprise, requiring a brand position rooted in scale, sophistication and sector-specific expertise. Pursuing diversification — say, launching a SaaS platform for a new client segment — requires a complete repositioning. You’re now a tech-forward solutions partner, not just a traditional service provider.

The important thing here is that most brands shouldn’t try to straddle multiple strategies at once. It’s hard to own a message of consistency and dependability while simultaneously asking the market to see you as cutting-edge and experimental.

And while the matrix is conceptually simple, its true power lies in decisiveness. The value comes when leadership teams pick a path and have the discipline to say “no for now” to the other three. That clarity sharpens positioning — and accelerates alignment across the business.

Framework 2: Understanding market perception with the Centrality-Distinctiveness (C-D) Map.

While the Ansoff Matrix helps you choose where to grow, the C-D Map helps you understand how your brand is perceived today and where you have permission to go next.

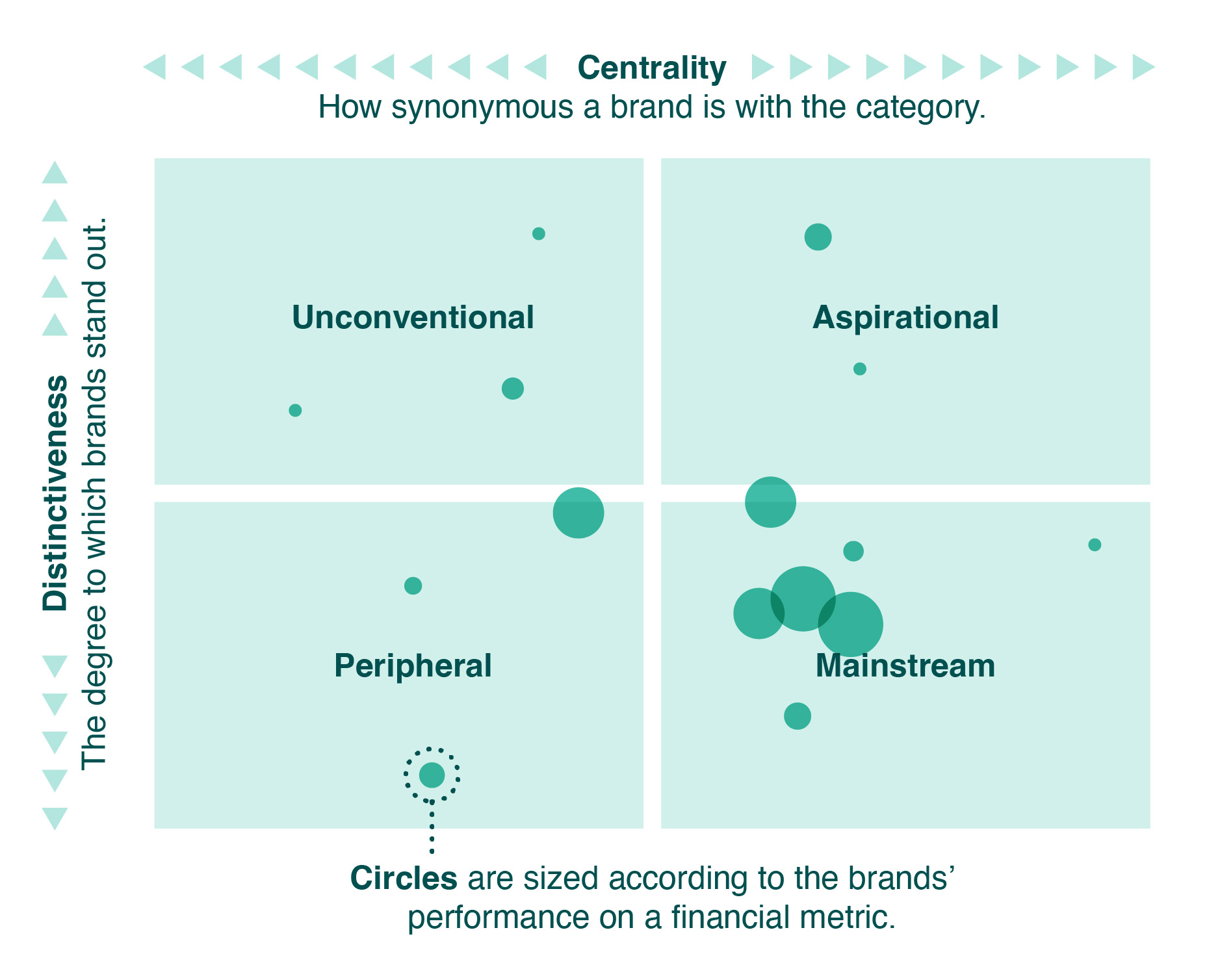

First published in Harvard Business Review in 2015, the model charts brands along two axes:

- Centrality: How typical or mainstream a brand is within its category

- Distinctiveness: How much a brand stands out from competitors

This creates four quadrants:

- Mainstream: Trusted, familiar category leaders (Coca-Cola)

- Aspirational: Admired and distinctive brands with broad appeal (Rolex)

- Unconventional: Niche brands with loyal followings (Trader Joe’s)

- Peripheral: Low visibility and low differentiation (local, lesser-known brands)

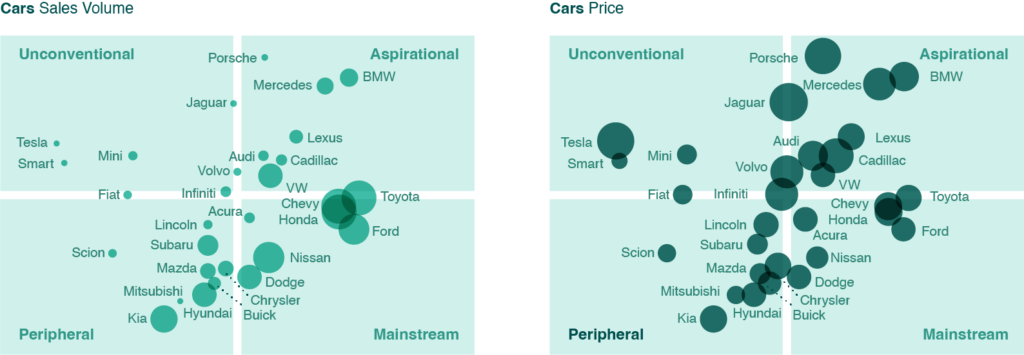

Each position comes with trade-offs. High centrality often yields high volume but limits pricing power. High distinctiveness allows for premium pricing but usually comes with lower market share.

To build a map like this, marketers would survey a broad swath of target audience for a category, asking individuals to rank brands based on how synonymous they are with a category (think Salesforce for CRM systems) and to what degree they stand out from others (consider pre-pandemic Zoom, when it was a tool that simply delivered better than all our other video conference options). Results are then plotted and compared with sales volume and price to create the final charts.

As an example, the auto industry map shows Toyota, Ford and Honda scoring high in centrality — and leading in volume — but pricing at the lower end. Aspirational brands like Porsche and Jaguar operate on the opposite end, commanding higher prices but serving a smaller share.

The natural inclination is to aim for the aspirational quadrant. But doing so takes discipline across every aspect of the business — from product development and customer experience to internal culture and messaging. The alternatives (unconventional, peripheral and mainstream) may seem less attractive, but are generally easier to achieve and can still yield impressively successful brands.

Ultimately, the important question isn’t “Where do we want to be?” It’s “What are we best built to deliver?”

Positioning truths for executive decision makers.

Clients often come to us during moments of transition — expanding into new markets, launching new services or reevaluating their growth strategy. These inflection points are where positioning decisions matter most.

Let’s be honest — positioning isn’t just about marketing. Positioning is a business decision with real implications for operations, product development, talent acquisition and profitability.

Some truths worth repeating:

- Your position must be authentic. Don’t chase premium pricing or trend-driven messaging if your operations can’t support it.

- Clear beats complex. A focused position will outperform a laundry list of services every time.

- Positioning requires trade-offs. You can’t be everything to everyone and every decision has consequences. The art is in choosing the trade-offs you’re willing to live with.

The good news? Whether you lean on one model or both, when you define a strong position, you give your marketing team a strategic foundation. More importantly, you give your organization a competitive edge.

Want to talk about your brand strategy and position? Get in touch. Our team helps leadership align around a single growth strategy, pressure-test it against real-world insights and translate it into a brand platform that supports business goals. Whether that means helping a brand shift quadrants on the C-D Map or simply execute their existing strategy more effectively, our approach is rooted in pragmatism, research and sharp strategic thinking. We love this stuff!