Activation

An evolving campaign poised for success.

Campaign objective.

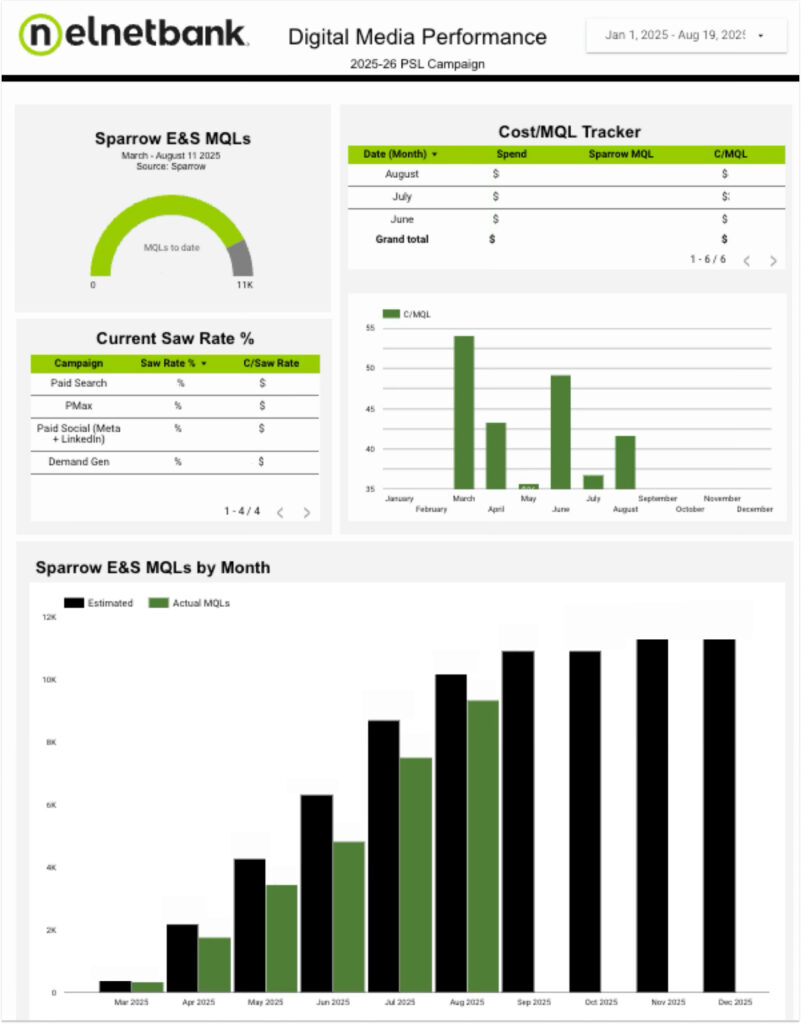

Nelnet Bank, a private student loan provider, set out to generate 11,000 marketing-qualified leads (MQLs) during the peak 2025 lending season at a disciplined target CPA.

The challenges:

The 2025 campaign aimed high on lead volume and performance while navigating the realities of a complex competitive, and regulated environment.

Rebuilding trust and visibility

Prior media efforts had included slower pivots in campaign direction and limited visibility for senior leadership. This campaign provided a chance to strengthen alignment and confidence through greater transparency and agility.- Evolving assumptions on lead quality

Early data revealed that not all MQLs contributed equally down-funnel, creating an opportunity to refine quality metrics and balance lead volume with value. - Competitive intensity

With Sallie Mae and College Ave outspending Nelnet Bank 10:1, strategic precision and budget agility were essential. - Brand crossover

Because Nelnet, Inc., the parent company, services federal student loans, branded search overlap introduced less-relevant traffic that required optimization. - Fair-lending requirements

As a regulated financial institution, Nelnet Bank could not use demographic targeting tied to protected classes. This meant relying solely on intent-based signals and campaign structure to drive efficiency.

Strategy.

We built a dual-track strategy to deliver meaningful lead volume while also providing opportunities to manage lead quality and overall campaign efficiency.

- SEM core campaigns

Our initial strategy included three campaigns. Each was given a separate target cost-per-acquisition (tCPA). Budgets were allocated based on data-backed performance, enabling the team to ensure that every dollar was spent wisely. - Performance Max (PMax)

PMax extended the campaign’s reach across Google’s search, display and video ecosystem, using AI-driven intent signals to both create and capture incremental demand for our search campaigns. This campaign also allowed us to gain premium placement in Google AI Overviews, boosting visibility at a lower cost.

Optimizations.

Our campaign saw impressive early success. However, volume initially outpaced lead quality, so we implemented a structured optimization framework built on four pillars.

Data integration & insights

Marketing performance was unified with business outcomes to identify which ad groups delivered qualified loan volume — not just leads. This led to us restructuring campaigns to prioritize quality-driving keywords.

Budget & bid agility

Our team reallocated budgets weekly based on real-time conversion trends, concentrating spend during peak demand, high-intent windows. We then used PMax as a safety net to capture incremental conversions at our tCPA.

Keyword refinement

We deployed extensive negative keywords to filter out irrelevant branded queries and increased conversion rates by tightening focus on student loan intent.

Transparent, collaborative management

Weekly alignment meetings were scheduled with senior leadership to review progress, while live dashboards provided visibility into what was happening, why and what came next.

Results

44% boost in site traffic

40% increase in lead quality

from month 1 to month 5.

11,539

MQLS generated

by month 7 — five months ahead of schedule.

Target

CPA

achieved

Impact.

This campaign proved that SEM success is about agility, not just spending. By integrating business data, AI-driven placements and transparent collaboration, Nelnet Bank exceeded its performance targets and strengthened leadership confidence in marketing’s ability to deliver business outcomes.